General lecture period summer semester 2024: 15.04.2024 to 12.07.2024 (with winter semester 2023/2024, 2nd exam period: 02.04. - 13.04.2024 (link CAU) - In accordance with the CAU's examination procedure regulations, there are no courses in bachelor's and master's degree programs during the examination periods (few exceptions for first semester students)).

More information at M. Sc. Biological Oceanography - information for students on OLAT.

Exam dates summer semester 2024: here (OLAT)

There is no general registration for courses - only for the exams at the end of the semester during registration phases (s.b.).

Notes on how to use the online tool can be found here:

If you have questions about the examination administration procedures in general (registration periods, examination periods, etc.) you may find answers in the Examination procedures section. If you are still unclear about anything you can contact the relevant Examination Office at any time.

Complete examination schedule SS 2024 (link to CAU).

Examinations:

Typical examination procedure:

- Examination registration: You register for the examinations that you would like to take in the next examination period or that are assigned to the next examination period (s.b. Examination Organisation Online (CAU)). In case of registration problems contact the Examination Office Biology.

During the registration period for the 1st examination period please register for all the written or oral examinations you would like to take in the 1st examination period (or around and assigned to the 1st examination period), but also for the examinations that you have already taken or started (e.g. seminar papers) during the lecture period (including before the registration period), as well as for examinations (e.g. assignments) that are to be taken during the lecture-free period.

Note: For examinations taken before the registration period, examination attendance is considered as binding registration. You must also register for these examinations during the registration period, however, so that your academic achievements can be recorded in the system at a later stage.

- Checking admission: Two days before the start of the examination period, you check whether you have been granted admission to the examinations you have registered for.

- Examination attendance: You take the examinations during the examination period.

- Checking results: You check the results entered by the examiners.

Examination Organisation Online (CAU)

Access to the online tool in the CAU-Portal: http://www.uni-kiel.de/hisinone

The online tool has the following functions:

- Registering for examinations / Cancelling registrations

- Information on registered examinations (checking admissions. Information on examination dates, times and rooms)

- Information on examination results

Notes on how to use the online tool can be found here:

You need your stu-ID to use the Studierenden-Online-Funktion online tool. Detailed information on the stu-ID and stu-e-mail address can be found at the Computing Centre StudiNet.

If you have questions about the examination administration procedures in general (registration periods, examination periods, etc.) you may find answers in the Examination procedures section. If you are still unclear about anything you can contact the Examination Office Biology at any time.

Registration period first exam phase summer semester: 03.06.2024 - 30.06.2024

First exam period summer semester: 15.07.2024 - 27.07.2024

Registration period second exam period summer semester: 26.08.2024 - 22.09.2024

Second exam period winter semester: 07.10.2024 - 19.10.2024

Complete schedule see CAU website and here (link to CAU).

Keep in mind - it's your responsibility not to miss any fixed dates and/or deadlines.

Practical courses, practical exercises and some seminars have compulsory attendance (FPO).

Make sure that you sign the attendance list every course day!

Framework of courses:

- All of the five first semester modules are compulsory.

- Passed core modules of the first semester (MNF-bioc-101 and MNF-bioc-102) are important for the understanding for the advanced modules of the second semester in summer (e.g. MNF-bioc-201 and MNF-bioc-202).

- Passed exams of ALL compulsory modules of first and second semester are the indispensable prerequisite for the exam of the core module of third semester in winter (MNF-bioc-301).

- A short presentation of your planned master's thesis ("proposal day") and a passed exam at the end of MNF-bioc-301 is the prerequisite to register your thesis (MNF-bioc-401) at the examination office.

For details concerning exams, prerequisites etc. look at the exam regulations in Biological Oceanography (p. 10-13).

Forms concerning exam withdrawal for good cause, medical certificate etc. (forms).

General regulations concerning examinations can be found here.

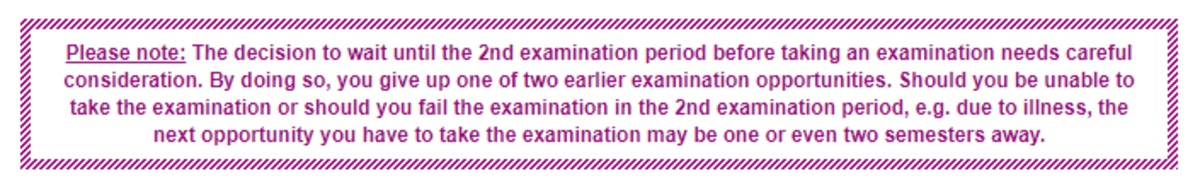

Considerations concerning using first or second exam phase (CAU).